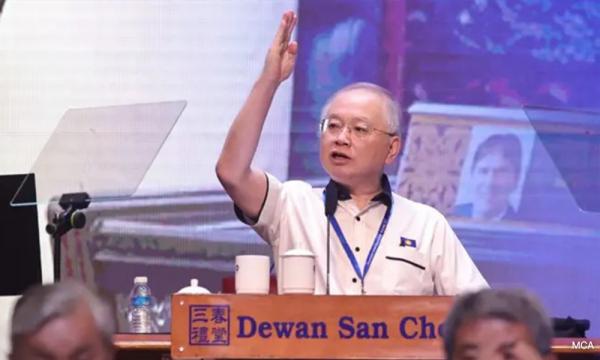

Wee Ka Siong Dismisses EPF Explanation for MAHB Stake Sale and Repurchase

Wee Ka Siong, the MCA president, recently shared his disbelief in the Employees Provident Fund’s (EPF) explanation for selling its stake in Malaysia Airport Holdings Berhad (MAHB) at a lower price and repurchasing it at a premium shortly after. In a video posted on Facebook, Wee Ka Siong expressed his skepticism, calling EPF’s explanation "just baloney."

The Story So Far:

In the realm of financial decisions and investments, the recent actions of EPF regarding its stake in MAHB have raised eyebrows and sparked discussions. The decision to sell at a lower price only to repurchase at a higher premium has left many questioning the underlying motives and strategies at play.

Full Review:

As we delve into the details of this intriguing saga, it becomes evident that there is more than meets the eye when it comes to EPF’s investment maneuvers. The storyline unfolds like a suspenseful thriller, with twists and turns that keep the audience on the edge of their seats.

The Intriguing Plot:

EPF’s decision to sell its stake in MAHB at a discounted price and then repurchase it at a premium seems like a strategic move, but the rationale behind such a decision remains shrouded in mystery. What prompted EPF to make such a bold move, and what are the implications for the future?

Unraveling the Performances:

In this financial drama, the performances of all key players, including EPF and MAHB, come under scrutiny. How did each entity contribute to the unfolding narrative, and what impact did their actions have on the overall storyline?

Direction and Decision-Making:

The direction taken by EPF in this investment saga raises questions about the decision-making process within the organization. Were these moves carefully calculated strategies, or were they impulsive decisions made in the heat of the moment?

Critical Reception and Audience Response:

As news of EPF’s investment maneuvers spreads, the critical reception and audience response have been mixed. Some view it as a bold and calculated move, while others see it as a risky gamble with uncertain outcomes. How will this narrative play out in the eyes of the public and the financial world?

Conclusion:

In conclusion, the EPF’s decision to sell and repurchase its stake in MAHB has sparked a wave of speculation and debate. As the story continues to unfold, one thing remains clear – the financial world is always full of surprises and twists that keep us all on our toes.

Frequently Asked Questions:

- **What prompted EPF to sell its stake in MAHB at a lower price?

EPF’s decision to sell its stake in MAHB at a lower price may have been influenced by various factors, including market conditions, investment strategies, and future projections. - **Why did EPF choose to repurchase the stake at a premium?

The reasons behind EPF’s decision to repurchase the stake at a premium are not entirely clear, but they may be tied to long-term investment goals, risk management strategies, or potential growth opportunities. - **How has the public reacted to EPF’s investment maneuvers?

The public’s reaction to EPF’s investment maneuvers has been mixed, with some praising the boldness of the move and others expressing concerns about the implications and risks involved. - **What are the potential implications of EPF’s actions on the financial market?

EPF’s actions could have a ripple effect on the financial market, influencing investor confidence, market dynamics, and overall stability in the investment landscape. - **Will EPF’s decision impact its future investment strategies?

EPF’s decision regarding its stake in MAHB may impact its future investment strategies, leading to a reevaluation of risk management practices, asset allocation, and overall portfolio diversification. - **How does MAHB factor into this investment saga?

MAHB’s role in this investment saga is crucial, as its performance, strategic direction, and market position all play a significant role in shaping the narrative and outcomes of EPF’s investment decisions. - **What lessons can be learned from EPF’s investment maneuvers?

EPF’s investment maneuvers offer valuable lessons in risk management, strategic decision-making, and the importance of thorough analysis and foresight in the world of investments. - **What are the long-term implications of these investment decisions?

The long-term implications of EPF’s investment decisions remain to be seen, but they could impact the organization’s financial health, reputation, and standing in the investment community. - **How can investors interpret EPF’s actions in the broader context of the financial world?

Investors can interpret EPF’s actions as a reflection of the ever-evolving and dynamic nature of the financial world, where strategic moves and calculated risks are part of the game. - **What are the next steps for EPF and MAHB in light of these developments?

The next steps for EPF and MAHB will be closely watched, as they navigate the aftermath of these investment decisions and chart a course for the future in an ever-changing financial landscape.Tags:

EPF, MAHB, investment, financial market, risk management, strategic decisions, market dynamics, investor confidence, portfolio diversification, asset allocation.